Understanding Affordability

How much of our income are we really spending on rent?

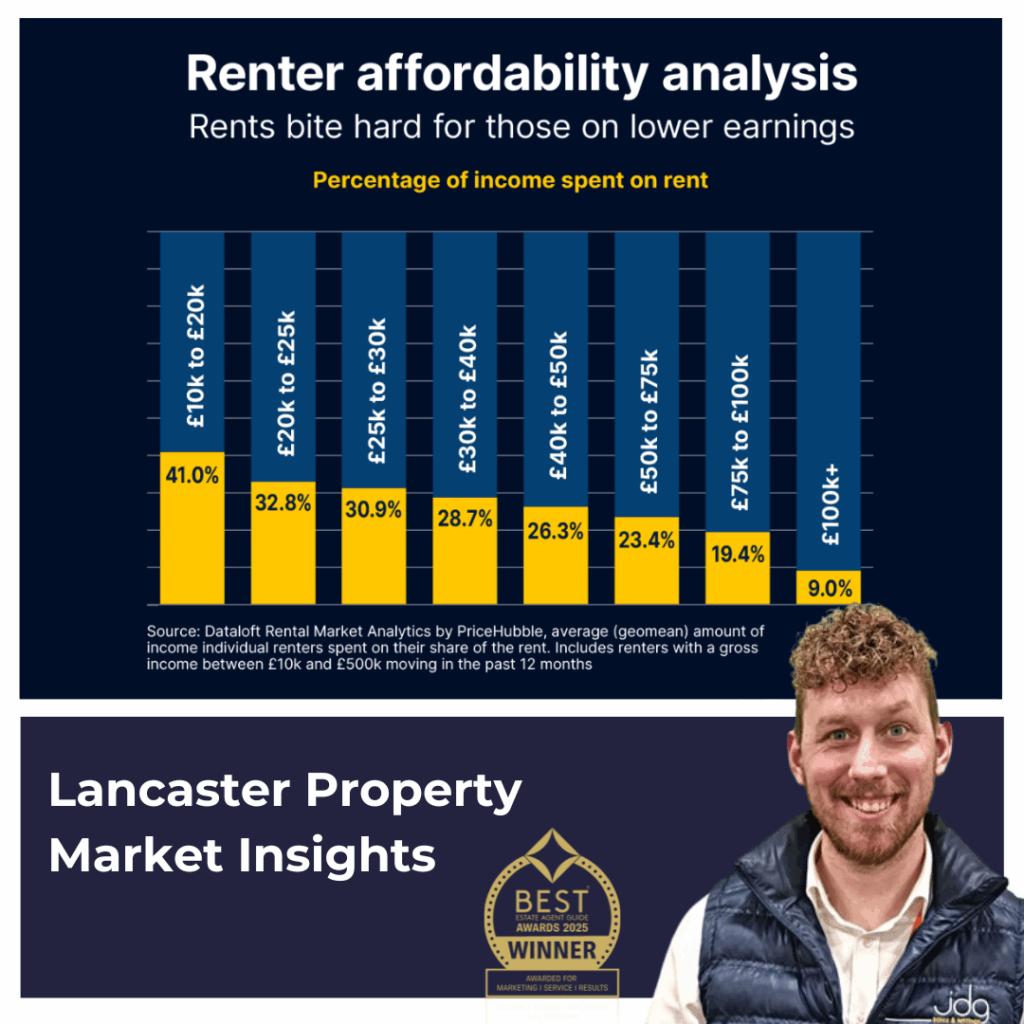

Affordability has become one of the most talked-about topics in the property world, and for good reason. Across Lancaster and Morecambe, renters are feeling the squeeze more than ever before. Recent figures show that renters on the lowest incomes – those earning between £10,000 and £20,000 a year – are spending over 40% of their earnings on rent. By comparison, those earning £100,000 or more spend just 9%.

Rental affordability is simply calculated by taking the rent as a proportion of income, but the story behind the figures is far more human. For many households, the rent is their biggest outgoing each month, and when costs rise faster than wages, it leaves little room for savings, holidays, or even day-to-day comfort.

The 30% Affordability Line

Property professionals often talk about a “30% rule” – the idea that spending more than 30% of your income on rent is considered unaffordable. For those earning under £30,000 a year, this threshold has already been breached. In fact, renters in this group are typically spending over 30% of their income on housing.

Here in Lancaster, the average rent for a two-bedroom home has risen steadily in recent years, driven by strong demand from professionals, students, and relocating families. In Morecambe, growing interest from buyers and investors, particularly since the Eden Project plans were announced, has added further upward pressure. While lower-income tenants may receive help through housing benefits or rent guarantees, the overall pressure on household budgets remains clear.

This isn’t just about individuals – it also affects our wider community. When people spend more of their income on rent, it impacts local spending, savings, and even future homeownership plans. The reality is that affordability challenges are now shaping how people live, work, and plan for their future.

A Market Balancing Act

Over the past five years, rents in key UK cities have risen by around 41%, while average earnings have increased by just 15%. That gap explains why affordability is now so stretched. Nationally, the latest figures show renters are spending an average of 29.3% of their gross income on rent – up from around 25% just a few years ago.

In Lancaster and Morecambe, the story mirrors the national picture. Demand for quality rental homes remains high, especially for well-maintained properties close to transport links, good schools, and local amenities. For landlords, understanding affordability is key – not only to ensure rents remain competitive but also to retain good tenants who can sustain payments long term.

Affordability will remain a central theme in our housing market for the foreseeable future. Whether you’re a landlord, tenant, or potential investor, it’s worth keeping a close eye on how income growth and rent levels move together. Here at JDG, we continue to track these changes closely to help our clients make informed decisions – because when it comes to housing, understanding affordability is essential for everyone.

If you would like to discuss this any further, then please get in touch. At JDG we are always here to help

Thanks for reading

Josh