The number of agreed UK property sales until the last Sunday of January (28th) is 8.35% higher than a year ago. Tumbling mortgage costs have encouraged buyers and sellers to return to the property market.

The market is more buoyant. Every UK region has seen an increase in the number of properties selling (subject to contract) in January 24 vs January 23; the most significant rise was found in Inner London, which was up 25.14% year-on-year. The smallest rise was in Scotland at 4.45%.

As well as increased property sales, the supply of UK properties on the market is 13.95% higher than a year ago. According to Zoopla, buyer demand is also up, on average by 12% across the UK. This is something we are also seeing at JDG. Remember though, buyers have choices out there.

Net sales (sales agreed less sale fall throughs) paint an even better picture, with a rise of 14.8% on average across the UK.

Growing optimism is evident among prospective buyers and sellers. Inflation is down. The average mortgage rates have dipped to their lowest point since early June, with some banks & building societies reducing mortgage rates to below 4% (for those with large deposits).

The reduction in mortgage rates since the Summer of 2023 has undoubtedly rejuvenated buyer interest and transactions, particularly after a slowdown in the latter half of 2023, when many prospective movers paused their plans. This resurgence is expected to help increase the number of properties sold, which, at one million, were at an 11-year low in 2023.

However, I cannot see this trend leading to a significant increase in house prices in 2024 since the market remains finely balanced. Sellers eager to move in 2024 might find encouragement in these initial signs of increased activity. Still, the buyer’s focus on value means that any undue optimism on the part of sellers could hold back the current property market recovery.

There are also warnings that the uncertainties often associated with a general election year inhibit the property market, as buyers and sellers become more cautious in their decisions in the lead-up to voting at the polls.

This is the time to be realistic with your pricing if you’re going to put your Lancaster home on the market

So, what sort of market are we in?

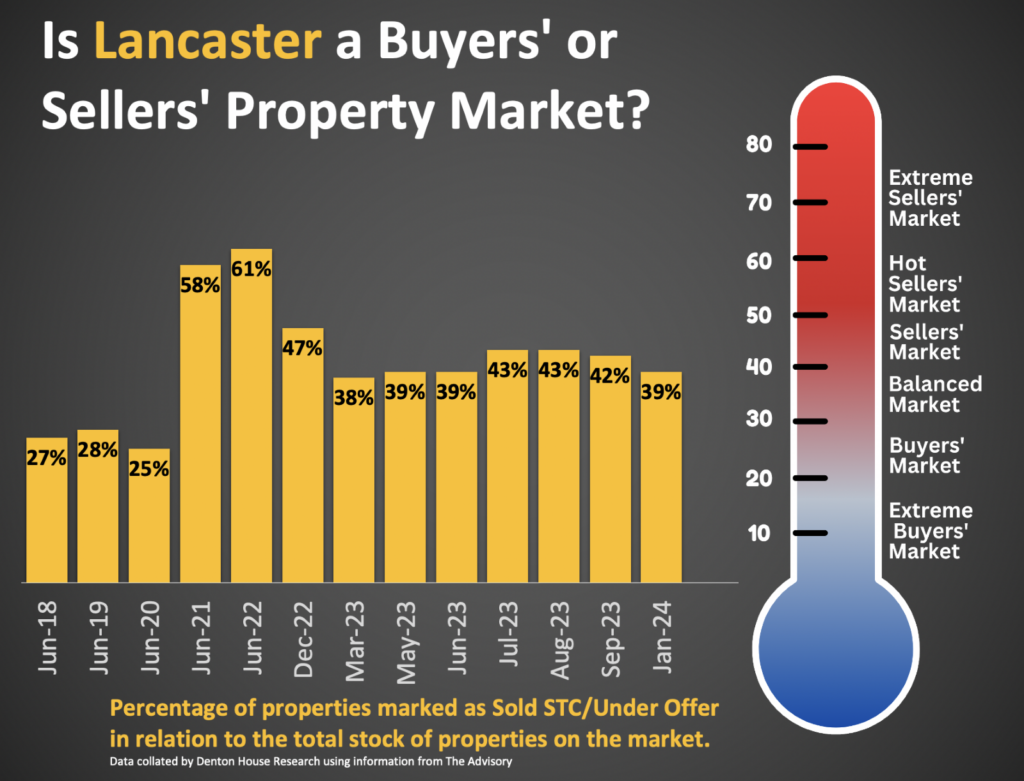

The measurement of whether it’s a buyers’, balanced, or sellers’ market is based on the proportion of properties marked as “Sold STC” and “Under Offer” compared with the total number of properties on the market, e.g., if there are 45 properties sold stc and 100 properties available/for sale, then 45 as a percentage of 100 is 45%.

This isn’t just a numbers game; it’s a gauge of market sentiment:

- Extreme Buyers’ Market (0%-20%)

- Buyers’ Market (21%-29%)

- Balanced Market (30%-40%)

- Sellers’ Market (41%-49%)

- Hot Sellers’ Market (50%-59%)

- Extreme Sellers’ Market (60%+)

The weight of these brackets can’t be overstated. They directly impact everything from listing prices to negotiation leverage.

Current Lancaster Property Market Snapshot

To calculate where Lancaster’s property market stands now, let’s incorporate our most recent findings for January 2024. The numbers and statistics have been taken from the website ‘The Advisory’, which has calculated the market state stats for many years. I am sharing them from the summer of 2018 to January 2024.

What are the Statistics for the Lancaster Area Since 2018?

Looking at each of the Lancaster postcode districts, each tells its own story…

| Jun-18 | Jun-19 | Jun-20 | Jun-21 | Jun-22 | Dec-22 | Mar-23 | May-23 | Jun-23 | Jul-23 | Aug-23 | Sep-23 | Jan- 24 | |

| LA1 | 31% | 35% | 29% | 60% | 65% | 53% | 44% | 45% | 46% | 48% | 48% | 48% | 44% |

| LA2 | 22% | 21% | 20% | 56% | 57% | 40% | 31% | 32% | 31% | 37% | 37% | 35% | 33% |

The average of the Lancaster postcode districts combined was quite clearly an extreme sellers’ market in the summer of 2022 at 61%. In 2023, the Lancaster property market changed, and it was hovering in the late 30% to early 40%, going from a balanced market to a sellers’ market. In January 2024, it slipped back into a balanced market, drifting downwards towards buyers’ market territory.

Consequences and Thoughts for Lancaster’s Property Market

This new data prompts me to take stock and ponder.

For Lancaster home sellers: We are transitioning into a market where sellers must be more strategic, flexible, and patient. Realistic pricing is even more vital than ever.

In 2022, for 75.7% of Lancaster properties that came onto the market, the owner moved (i.e., exchanged and completed) instead of withdrawing off the market, unsold. In 2023, that figure had reduced to 61.3%, (interesting, when compared with the national picture when it was 65.33% in 2022 and 52.86% in 2023).

For Lancaster home buyers: What are the challenges and opportunities? Some homes will still have bidding wars, yet you will have the luxury of choice and time with others.

External influences, from global economic trends, inflation and interest rate repercussions could all cast shadows on the Lancaster property market. The pre-election Budget will no doubt affect the property market as will everything going on ice in the three or four weeks up to the election itself.

Delving Deeper: Strategies and Tactics to Sell Your Lancaster Home

Given the property market’s temperature, here are more granular insights:

Sellers: I’ve already mentioned, pricing is absolutely key to finding the right buyer. Also, the marketing to make your home stand out is vital – like video/virtual tours, specialized social media campaigns or interactive property listings—could make a difference in a cooling market.

Buyers: Again, there is more than one market (look at the differences between the Lancaster postcode districts above). The competition will heat up if you are looking for the type of property everyone wants. Having your mortgage pre-approval in place will give you an advantage over other buyers. Also, it is worth being open to widening your search radius to spot bargains others could miss.

Did you know? 81% of sellers are also buyers. So, what you might lose from selling in a buyers’ market means you gain when buying

Final thoughts

As we enter the second month of 2024, the Lancaster property market offers both challenges and opportunities for Lancaster’s home buyers and sellers. Understanding the market nuances is vital if you are a Lancaster first-time buyer, an existing homeowner looking to move, a seasoned property buy-to-let investor, or someone looking to relocate.

Stay adaptable, stay informed and remember that, as always, your home-moving story is as much about the journey as the destination.

What are your thoughts on Lancaster’s evolving property scene? Do you anticipate any other trends or shifts in the Lancaster property market? What are your local insights and experiences?

You can email me at michelle@jdg.co.uk or call me on 01524 843322. At JDG we are here to help.

Thanks for reading

Michelle