Today we want to talk money. It’s a subject that many people don’t like to discuss, for many still a taboo subject.

The media is full of families struggling. The demand for food banks is at an all time high. Many people have been furloughed, picking up only 80% of their salaries. Others have lost their jobs. And some self employed have slipped through net, not knowing which direction to turn.

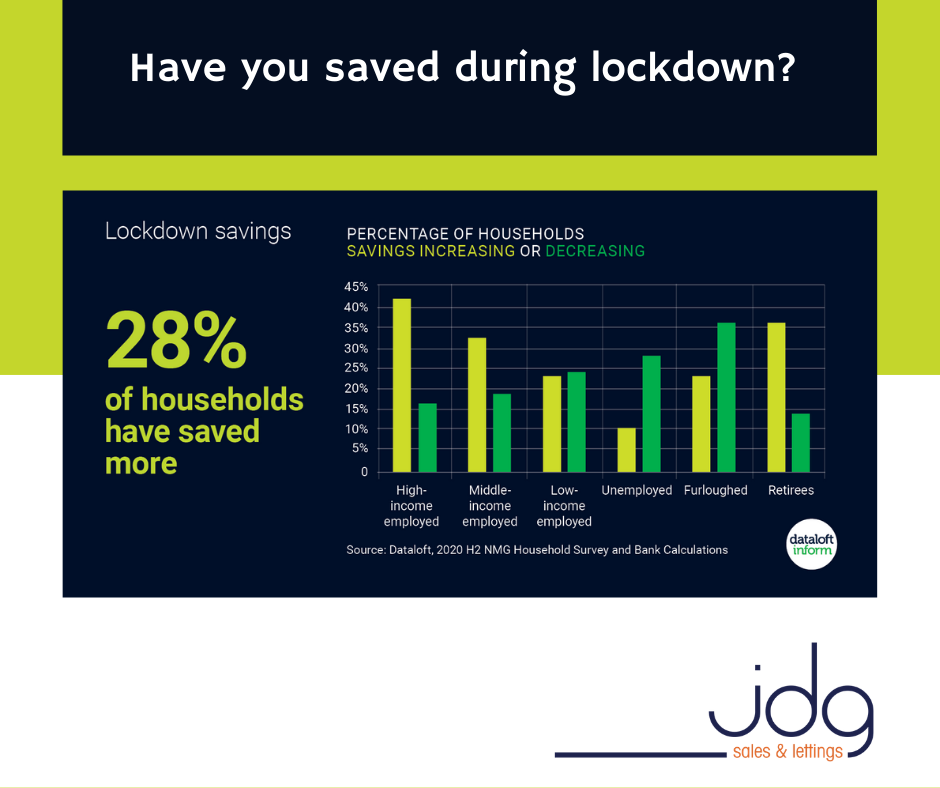

However, despite all of this 28% of households have saved money. So who are the winners and why?

High Income and Middle Income Employed

On average 42% of the high income employed and 32% of the middle income have saved money. Working from home has meant less outgoings in terms of travel expenses, car parking fees and even buying lunch out. In Lancaster, daily car parking fees can often be as high as £8 and when you allow £5 extra for lunch or a takeaway coffee and cake, it soon adds up!

This sector has also saved money by not being able to go on holiday nor being able to do much dining out in restaurants. They’ll still get the occasional treat though, like a restaurant meal delivered to their home and they are likely to buy themselves new clothes, flowers for the home and other little luxury gifts. Everyone loves a treat and I’m sure several of us have bought new clothes with no where to actually go and wear them!

Low income employed

In this sector 50% of people are no worse but also no better off. Some have saved, some haven’t. It falls at approximately 25% each. Work hasn’t changed. Many will be key workers, working in supermarkets, care homes etc…. There costs are often the same. There outgoings are often the same. Those that have saved tend to be due to not going on holiday. Those that finacially worse off, tend to have spent a bit more trying to keep the family spirits up.

Who hasn’t spent a bit of money getting Netflix, extra Sky channels and on some home improvements during lockdown?

The unemployed

Why have 29% of the unemployed seen savings decrease? It’s a genuine question we have been asked recently. What we have to remember is that the number of unemployed increased by 370,000 from August to October last year. These people have lost their income and many are now relying on universal credit. Many will still have mortgages, car loans and credit cards to pay.

For those that were already unemployed, they have found their household costs increase with their children being at home. More food has to be bought. Heating and hot water bills will have risen. And we all know, that children will ask for more from simple things like an extra bag of crisps through to the latest computer games.

Furloughed households

24% of furloughed households have actually saved money. These households were already earning below the maximum £2500 allowance. Like the high and middle income workers, they have saved by not going to work in travel expenses and the occasional coffee / lunch out. They have saved by not going on holiday and many have been careful about what they spend their money on, not knowing what the future looks like.

36% of furloughed households though have had to dip into their savings. In this instance the £2500 maximum is less than 80% of their income and despite getting maxiumum amount, these people tend to have larger mortgages, car finance. Talking to this sector, you start to understand that their outgoings and commitments are high – even a holiday home on a caravan site still needs paying for and there are people who have car finance at over £600 per month, some even higher than that!

Retirees

Over a third of retirees have saved money. Only 14% have seen savings decrease and talking to this sector one of the reasons they have decreased is due to helping struggling family members out.

Those that have saved, have saved due being able to not go anywhere. Their pensions are still being paid and in the main they have been unaffected. Some are reporting that their investments have actually increased ( after the initial drop in lockdown 1). Others are saying that because they have been isolating, they have spent very little. My parents fall into this category – every holiday booked has been cancelled and they have no mortgage to worry about.

What people intend to do with their savings will have an impact on the future of the economy. Many will choose to improve their homes. Others will choose to move. We’ve been seeing it already with the mini housing boom in the latter part of 2020 as people are finding they spending more and more time at home. Where we live is important. It’s our place of safety and comfort. It is where memories are made and families brought up.

My name is Michelle Gallagher. If you want to discuss the article or the current state of the Lancaster and Morecambe housing market, please get in touch. At JDG we are here to help.

Thanks for reading

Michelle x