Many people are wondering what is fuelling the housing market. Why are prices being pushed so high? Is now, really a good time to buy?

Property prices are at an all-time high in Lancaster and Morecambe. Houses are selling quickly, often with multiple offers, pushing prices higher than before.

The Bank of England has said the UK is set for its strongest economic growth since WWII. Families have savings and many are looking to invest these savings in bricks and mortar. The stamp duty holiday has fuelled this as people rush to get moved. Many families are looking to upsize as they are now spending more time at home and as working from home becomes the future for many of us, our home and we use it becomes more important.

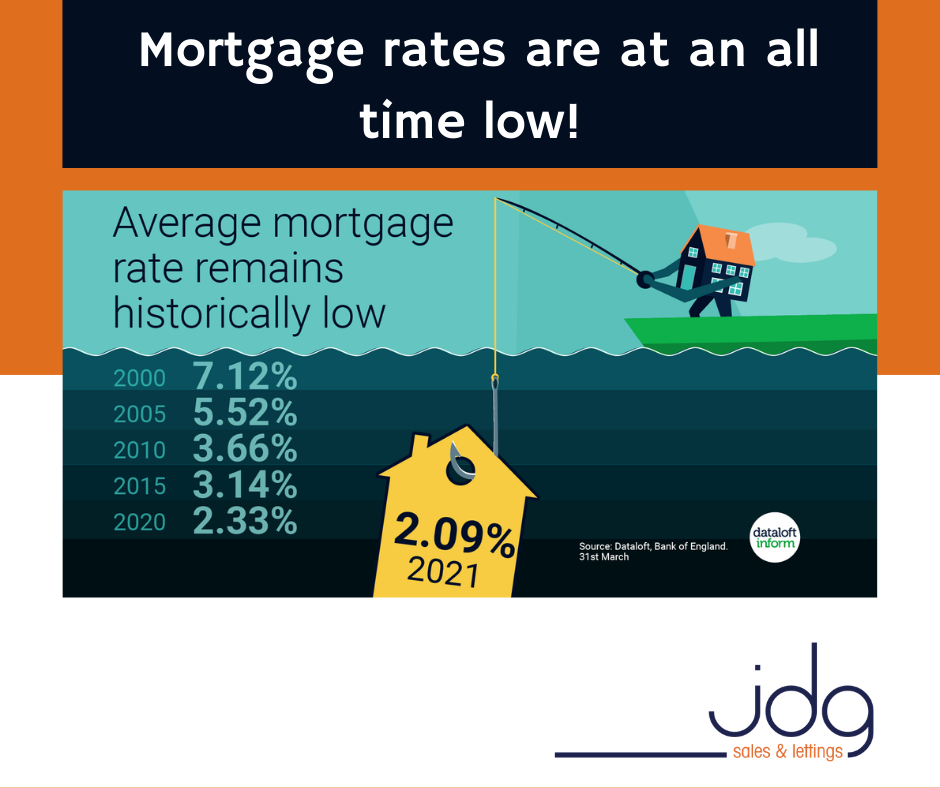

One of the things that some people have overlooked when they talk about why people are moving, is that the cost of borrowing is at a historically low level. Back in 2000, the average mortgage rate was 7.12%. In 2005 it was 5.52%. In 2021 it is down at 2.09%. It is cheap to borrow money.

This rate has remained unchanged since the start of 2021, with gross mortgage lending in March hitting its highest ever monthly total at £35.6 billion. Mortgage approvals remain over 20% higher than the long term (5-year average), as interest in moving home continues.

The Bank of England Monetary Policy Committee voted unanimously on 5 May to maintain rates at 0.1%. The next meeting is on 16th June.

One thing for certain is that if the Bank of England is right with their economic forecast, the housing market is set to continue well into 2022!

If you would like to discuss the Morecame or Lancaster housing market, please get in touch. At JDG we are here to help.

Thanks for reading

Michelle