Are you planning to buy a new build house for your first home? If so, a new government scheme might be able to save you up to 30%.

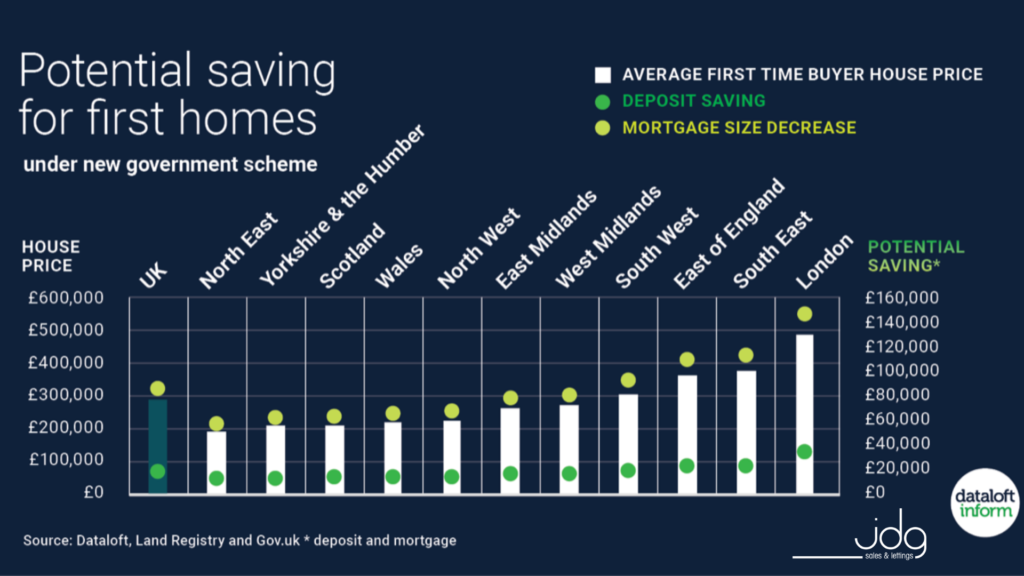

It’s called the “First Homes” scheme, and it would reduce the average price of a first-time buyer property in the UK from £285,874 to £200,112 (November 2019). Assuming a 20% deposit and 80% mortgage, using the First Home scheme, a deposit of £40,022 and mortgage of £160,089 would be needed. Therefore, the First Homes scheme would reduce a first-time buyer deposit by £17,152 and the mortgage needed by £68,610.

Initially it is believed that the First Homes discounts will be prioritised for veterans and key workers such as nurses and police. The discount will be locked into the property to ensure more first-time buyers benefit in years to come. The government is still consulting on the details of the scheme.

With the Help to Buy scheme due to end in 2023, First Homes could help plug the gap. However, there are concerns that First Homes will come at the expense of traditional affordable housing, such as affordable rent, social rent and shared ownership.

If you are looking for your first home in Lancaster or Morecambe, or if you’d like to discuss any aspects of the local property market, call into our office on Market Street in Lancaster. At JDG we’re here to help.