The UK’s property market is facing a significant challenge as the availability of homes for rent has plummeted to its lowest level in five years, exacerbating the difficulties tenants face in finding affordable accommodation.

This alarming trend was highlighted in a recent analysis, which revealed that in 2023, only 261,542 private rental homes were available per month in the UK, marking a steep decline from the 379,459 monthly average of rental homes available in 2020 – a drop of 31%, underscoring a worrying trend that has been developing over recent years.

This scarcity of rental properties is occurring against a backdrop of increasing mortgage costs for landlords, which, in turn, places additional pressure on the rental market.

Higher interest rates, coupled with a high demand for rental properties, have led to significant increases in rental prices (rising from £1,343 pcm in 2020 to £1,739 pcm in 2023 – an increase of 29%), making it increasingly difficult for tenants to find affordable housing.

The difficulties tenants face are further compounded by the financial pressures on mortgaged landlords, who have seen the affordability of mortgages decline sharply. An increase in mortgage rates has left many landlords having to face the choice of increasing the rent to cover the increased costs or deciding to disinvest – eg sell the property. The people it is affecting most are the ones with lower incomes and lower savings.

The UK rental market’s dynamics have shifted significantly, with rents rising by 29% as available rental stock dwindled by 31% since 2020.

The supply crunch in the rental market has led to increased competition among prospective tenants, with many properties being let almost immediately to higher-earning tenants. This competition drives rents upwards, making it even more challenging for new tenants to find affordable housing. Additionally, the reluctance of existing tenants to move, fearing higher rents elsewhere, contributes to the shortage of available properties, as fewer tenancies are ending and coming back onto the market.

This situation is particularly acute at the lower end of the price spectrum, where the availability of homes to rent for less than £1,000 a month has significantly declined, making it even more challenging for those on tighter budgets to find suitable housing.

740,027 sub £1,000 pcm UK rental properties came onto the market in 2020; this dropped to 464,774 in 2023, a drop of 37.2%.

How is this an opportunity for Lancaster landlords?

The current property market could present a notable opportunity for Lancaster landlords. To do that, we must look at the background statistics and numbers for the Lancaster area.

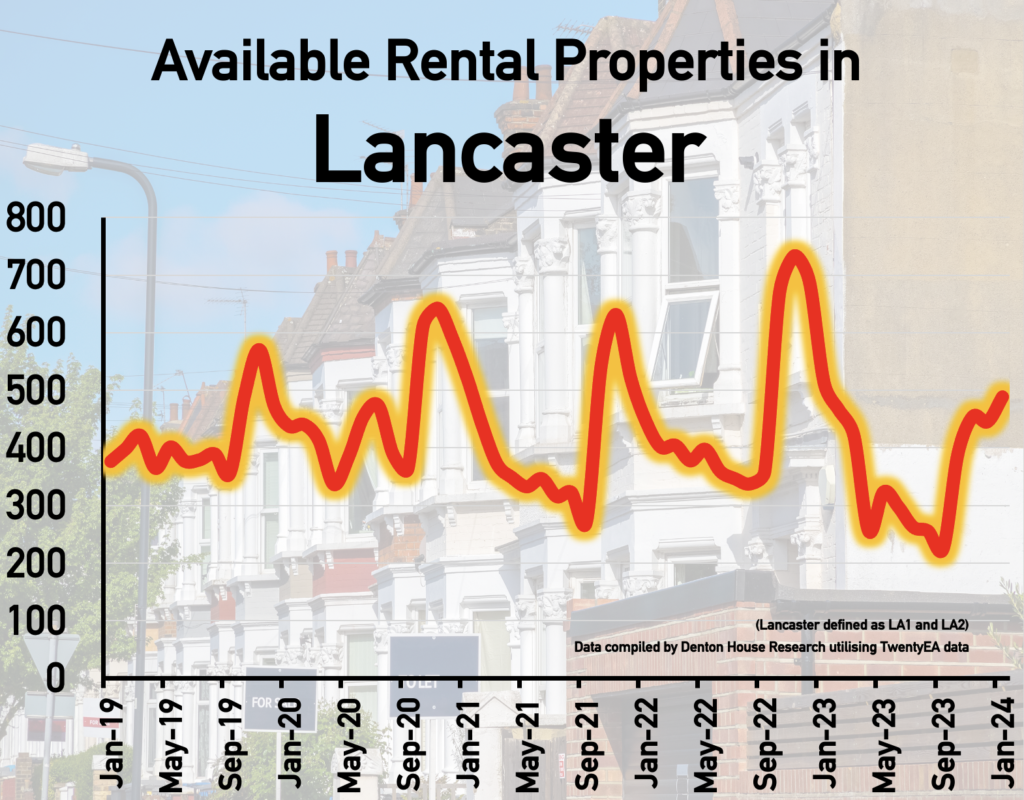

These are the average monthly stock levels of private rental homes in the Lancaster area (LA1 and LA2) …

- 2019 – 416 rental properties per month in the Lancaster area

- 2020 – 461 rental properties per month in the Lancaster area

- 2021 – 413 rental properties per month in the Lancaster area

- 2022 – 460 rental properties per month in the Lancaster area

- 2023 – 368 rental properties per month in the Lancaster area

The average rent in the Lancaster area in 2020 was £667 per calendar month; in 2023, it was £815 per calendar month.

Lancaster rents have risen by 22%, as available rental stock dwindled by 20% since 2020.

The escalation of rental prices signifies a robust income stream for Lancaster property investors. This is particularly advantageous in a market where high demand ensures properties are let swiftly, often to quality tenants willing to pay a premium for scarce housing options.

Furthermore, the challenging mortgage landscape, with rising buy-to-let mortgage rates with high percentage mortgages, has meant more landlords leaving the market, thereby reducing competition and potentially increasing the demand for existing Lancaster rental properties even further.

What about Lancaster tenants?

As the UK grapples with this challenging rental market landscape, there are two keys issues that tenants are facing – affordibility and the overall availability of rental properties.

We all know that he Government needs to build more homes. Yet excluding land, the building costs in the UK start from £163 per square foot. An average 3-bed semi is 1000 ft.². The most conservative estimate shows that Britain is approximately 2 million households short now, meaning the bill for those additional 2 million homes would be £326bn (excluding the land). For context, the NHS costs £181bn a year!

The Government currently spends £17.35bn a year on housing, which would need to increase to £49bn a year for the next ten years to pay for those 2 million homes. To give you an idea of what that would cost taxpayers …

Income tax would need to rise by 5.81 pence in the pound to pay for those additional 2 million homes!

That is the equivalent of an extra £991 per year for every taxpayer for the next ten years – not a vote winner! Yet without significant Government intervention and strategic planning, the difficulties tenants face in finding affordable homes will likely persist, with potential long-term implications for the housing market and the broader economy.

Meanwhile, British landlords must continue to buy properties. Across the UK, we need more rental properties. Unfortunately, it is the nature of the game that with limited supply and increasing demand, prices (i.e., rents) go up.

Our heart goes out to Lancaster tenants having to pay these increased rents, but the market is the market, and we cannot control that. Whilst at JDG we are very conscious about affordability, it has been proved beyond doubt, in Scotland and around the world, that rent controls do more harm than good, so I hope that the Government starts to listen and comes up with solutions that suit the needs of our nation.

What are your thoughts? I know this article will ruffle a few feathers, and I would like to stress that we are genuinely concerned about rental affordability across Lancaster and Morecambe. Do you have any workable suggestions?

All I do know is that we are still seeing a high demand for rental property for pre-qulaified waiting tenants. If you have a property to let in Lancaster or Morecambe, we would love to chat with you.

Thanks for reading

Josh